Valuation Components

Objective: Gain an understanding of how to create a Valuation record for a Component.

Prerequisites: This action requires some things to be completed prior to commencing. Asset Record must exist in the database. Component Record must exist in the database.

What is a Valuation Component?

Valuation components provide an organization with the ability to account for maintenance works at a subcomponent level for existing asset component records.

An example is that of a road segment, which requires a section replaced, and the new section has a longer remaining life than the original road segment.

In this circumstance, there is the requirement to be able to track and value both the original segment as well as the new section that is located within the old segment.

Once the valuation component is created, it will contribute to the overall value of the asset and can be summed to provide overall valuations, but can also be managed separately due to it being in better condition than the surrounding road.

How to Add a Valuation Component

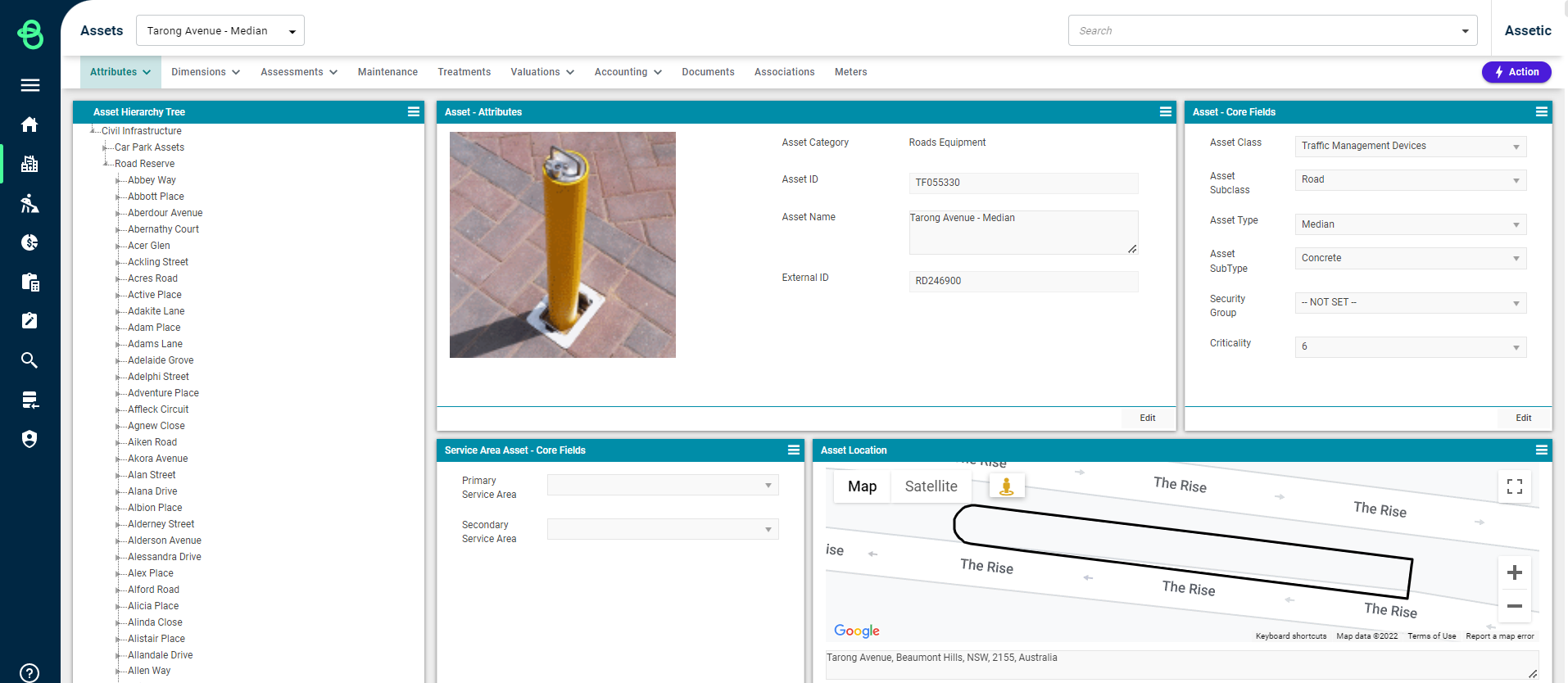

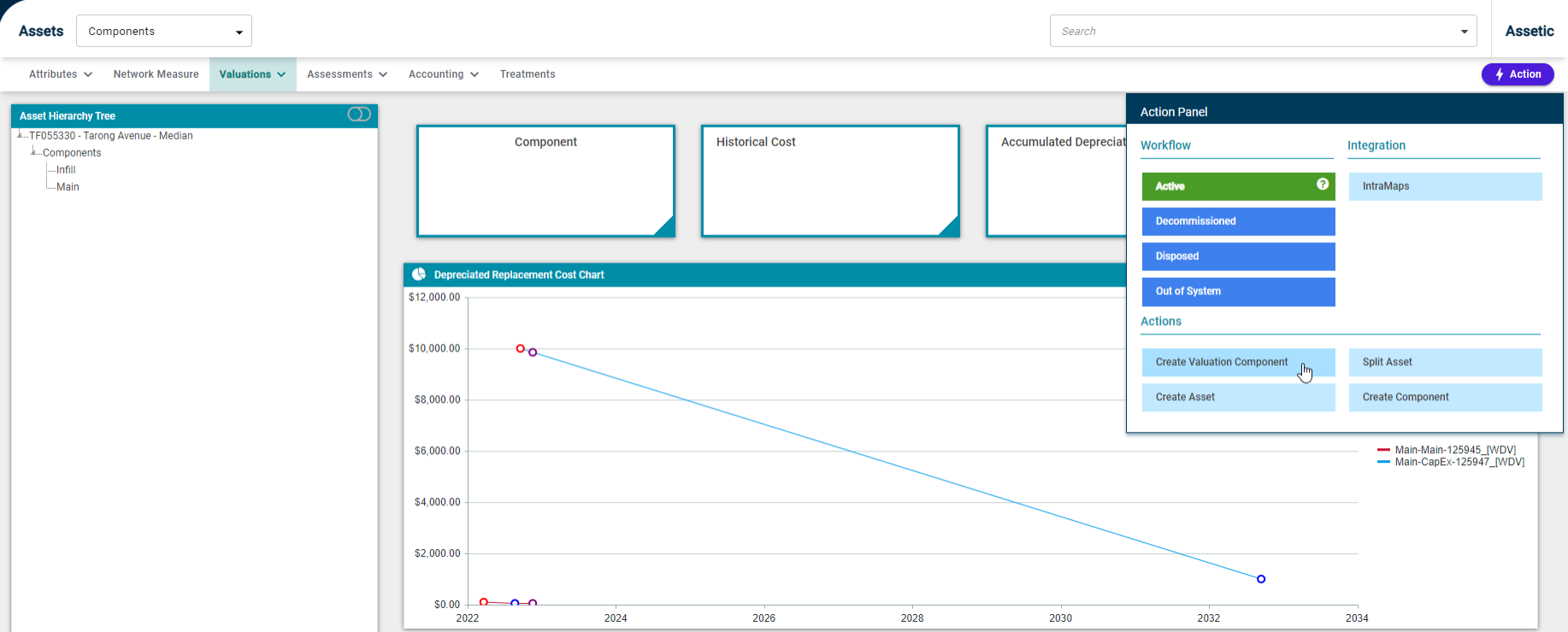

Start by navigating to an asset that requires a valuation component to be added.

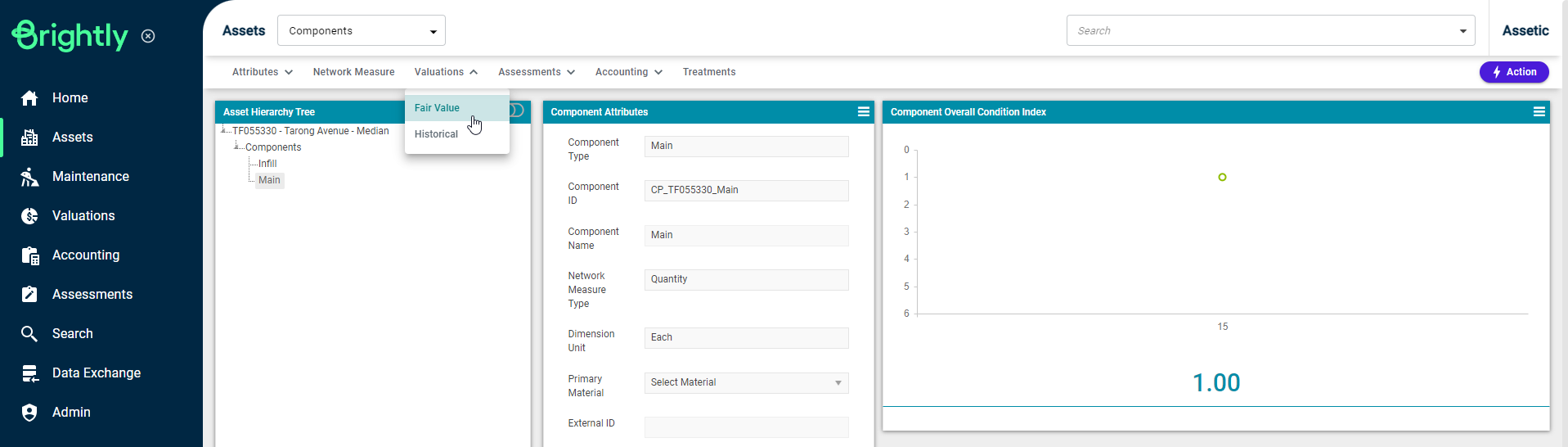

Select the Component and click on Valuations and then select either Fair Value or Historical Value.

Fair Value

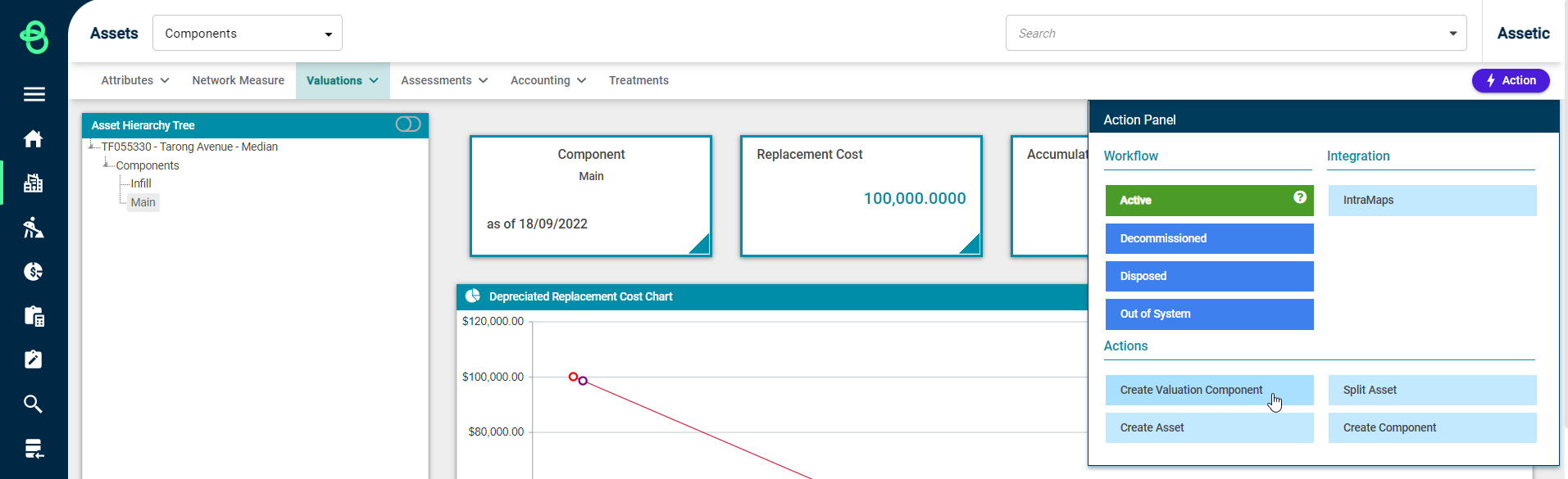

Next, choose 'Create Valuation Component' from the Actions menu.

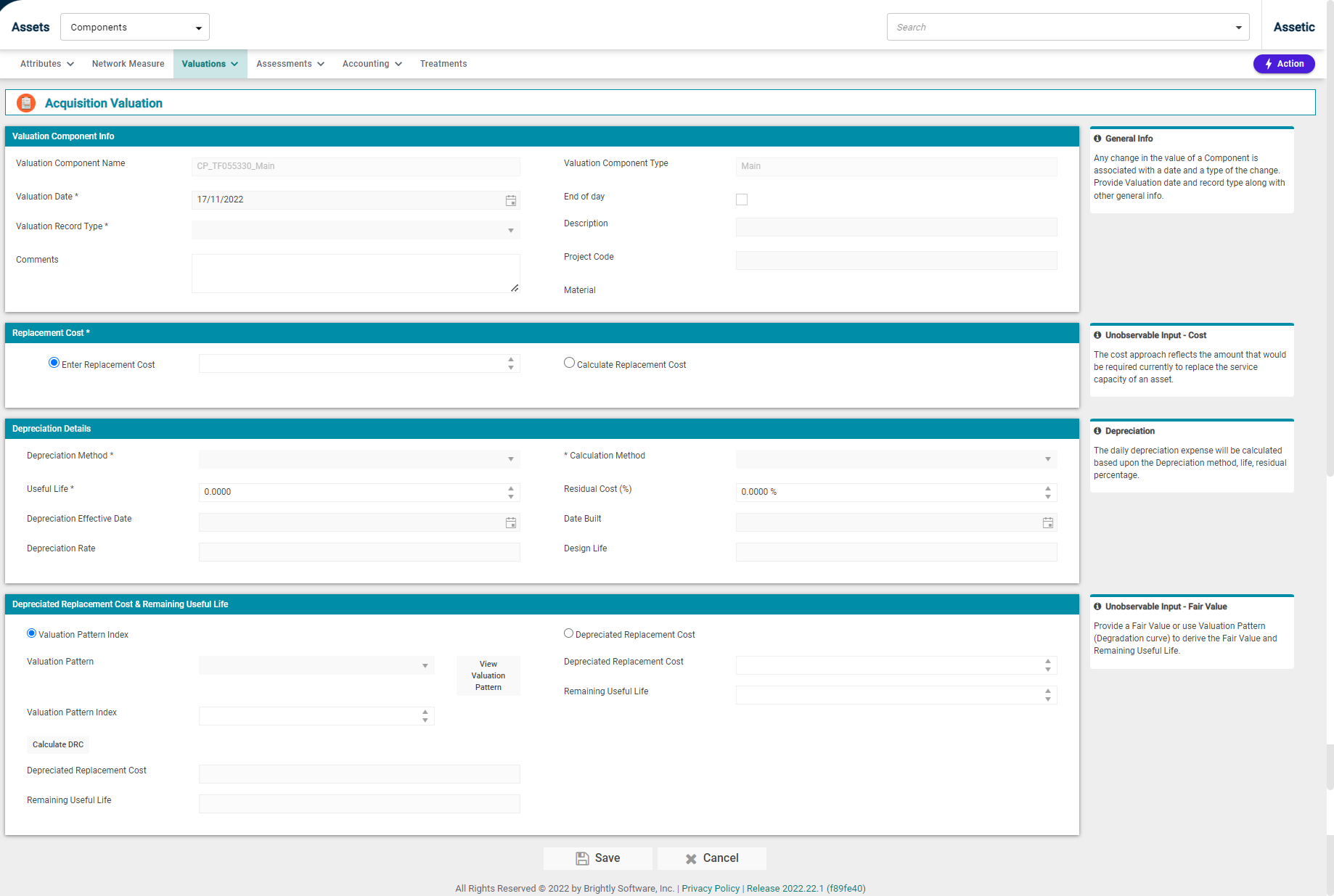

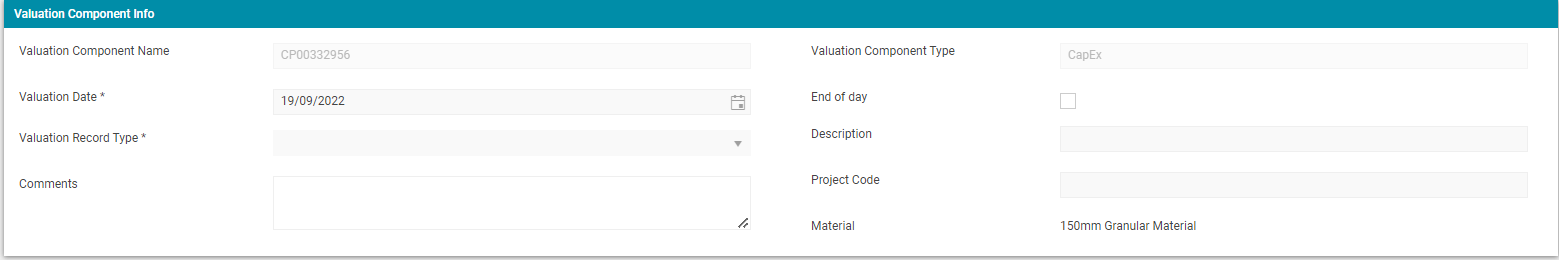

The following screen will display:

Each section found here is used in the creation of a Valuation Component and is detailed below.

Valuation Component Info:

-

Valuation Component Name: This is not user-configurable and is populated from the parent component reference.

-

Valuation Date*: A mandatory field that is pre-filled with the current date.

-

Valuation Record Type*: This is a mandatory field which allows the user to select a valuation record subtype under Acquisition. For a 'Main' valuation component, the available record subtypes are: Purchase, Opening Value, Found Current Period, Found Prior Period, Gifted, Constructed. For a 'Capex' valuation record, the available record subtypes are: Purchase, Opening Value, Acquisition External Valuation, Found Current Period, and Found Prior Period.

-

Comments: A free-text box for any additional information.

-

Valuation Component Type: This is not user-configurable and is auto-populated from the parent component record. On a component with no valuation component records, the first acquisition will always be Main, and all subsequent entries will be Capex.

-

End of day: This checkbox indicates when the valuation is measured from. If checked, the valuation will be measured from the start of the next day.

-

Description: A free-text field where the description can be stored.

-

Project Code: This can be used to allocate the valuation to a specific project.

-

Material: This field is with the Material from the Parent Component, and cannot be directly modified at the Valuation level.

-

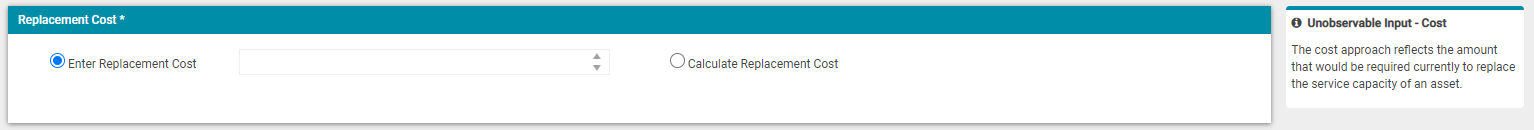

Replacement Cost*:

Replacement Cost requires a choice between one of the two available options:

-

Enter Replacement Cost: This field uses a numeric value, as shown above.

-

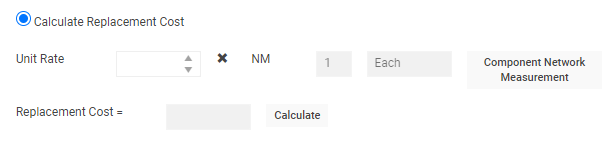

Calculate Replacement Cost: This allows the Replacement Cost to be calculated by the system, as shown here:

-

Unit Rate: Input a unit rate in the field, or use the numeric stepper to select the unit rate.

-

Calculate Network Measure: NM and Replacement Cost fields are not editable and are populated based on Unit Rate.

-

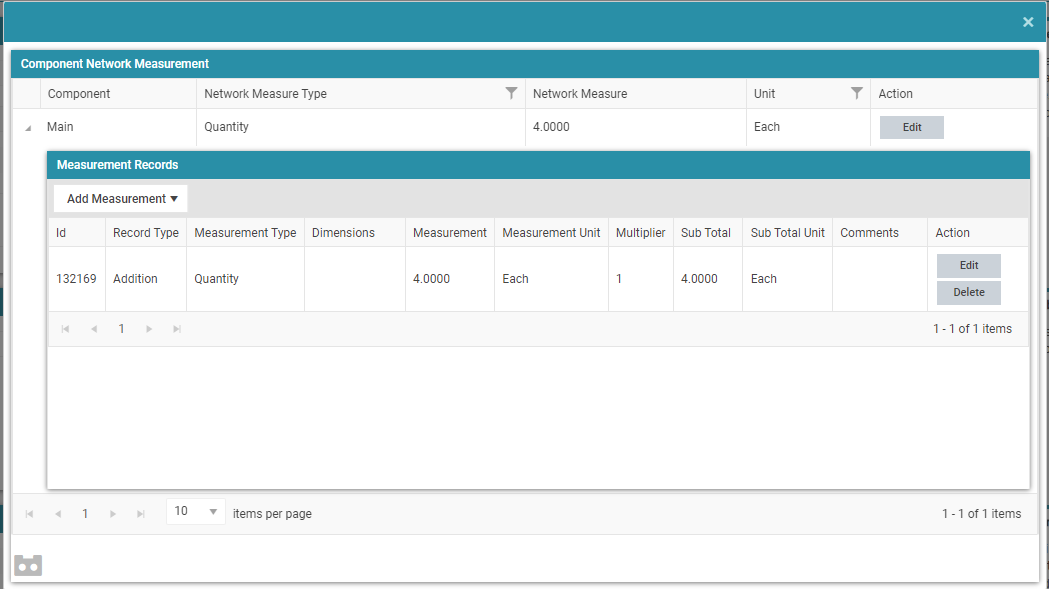

Component Network Measurement:

-

Add Dimension Record: To learn more about adding dimension records, please refer to this article: Network Measure

-

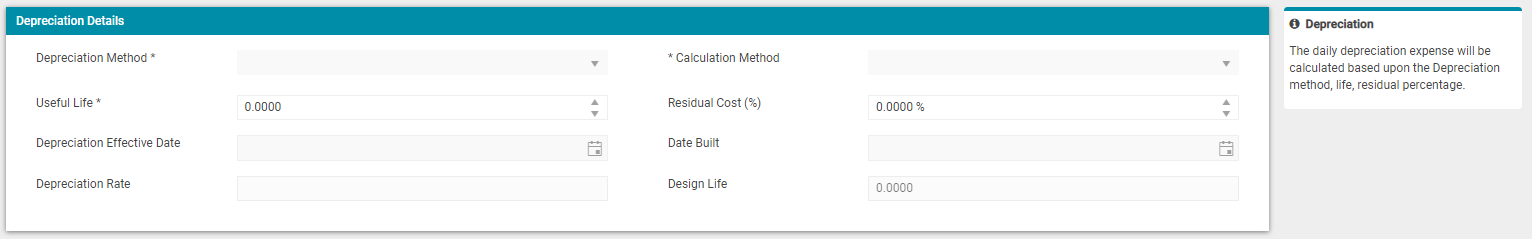

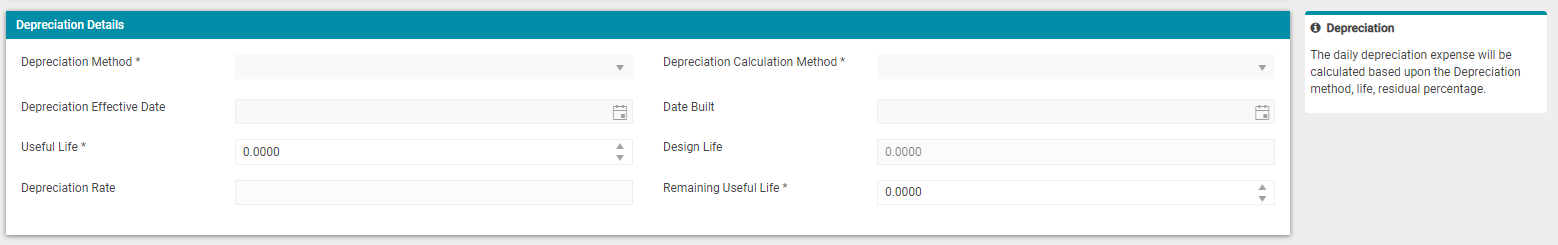

Depreciation Details:

-

Depreciation Method: This is a mandatory drop-down field from which a Depreciation Method must be selected.

-

Depreciation Calculation Method: This is a mandatory field that contains the following options:

-

Prospective (RUL): This is a forward-looking approach to calculating the depreciated replacement cost.

-

Retrospective (UL): This approach is used to calculate depreciated replacement cost if the initial asset value requires updating that will affect the depreciated value.

-

Retrospective (Estimated UL): This is backward-looking with an estimated approach to calculating depreciated replacement cost.

-

Useful Life: Useful Life is a mandatory numeric field.

-

Residual Cost (%): A numeric field to select a Residual Cost value as a percentage.

-

Depreciation Effective Date: Depreciation Effective Date is the date from which depreciation is calculated.

-

Date Built: Date Built is the date when the asset was constructed.

-

Depreciation Rate: Depreciation Rate is not editable and is system calculated based on the previous inputs.

-

Design Life: Design life is not editable and is system calculated based on the previous inputs.

-

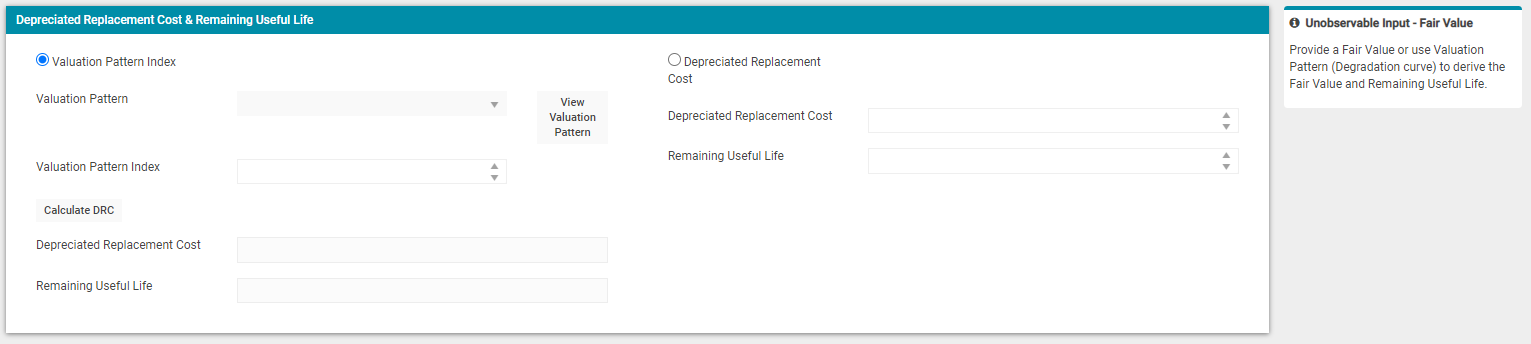

Depreciation Replacement Value & Remaining Useful Life:

There are 2 approaches to calculating these figures:

-

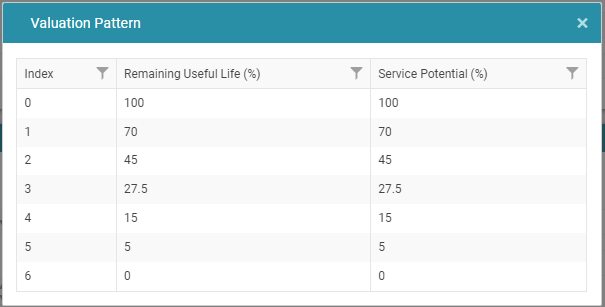

Valuation Pattern Index: Valuation Pattern is used to generate the Depreciated Replacement Value (DRV) using the Valuation Pattern and Valuation Pattern Index. Select the Valuation Pattern Index radio button, then select the appropriate curve from the Valuation Pattern drop-down. By selecting the ‘View Valuation Pattern’ button, the following will be displayed:

-

Depreciated Replacement Cost: The Depreciated Replacement Cost is used when the asset has been independently valued and there is available data for the Valuation Pattern (life cycle curve) and the Index (condition). Click the ’Calculate DRC’ button and the system will generate the Depreciated Replacement Value (DRV) - in other words, what the asset is worth today - and the ‘Remaining Useful Life.’

Select the Depreciated Replacement Cost radio button, and populate the Depreciation Replacement Value cell with current data.

Then populate the Remaining Useful Life cell with current data and select Save.

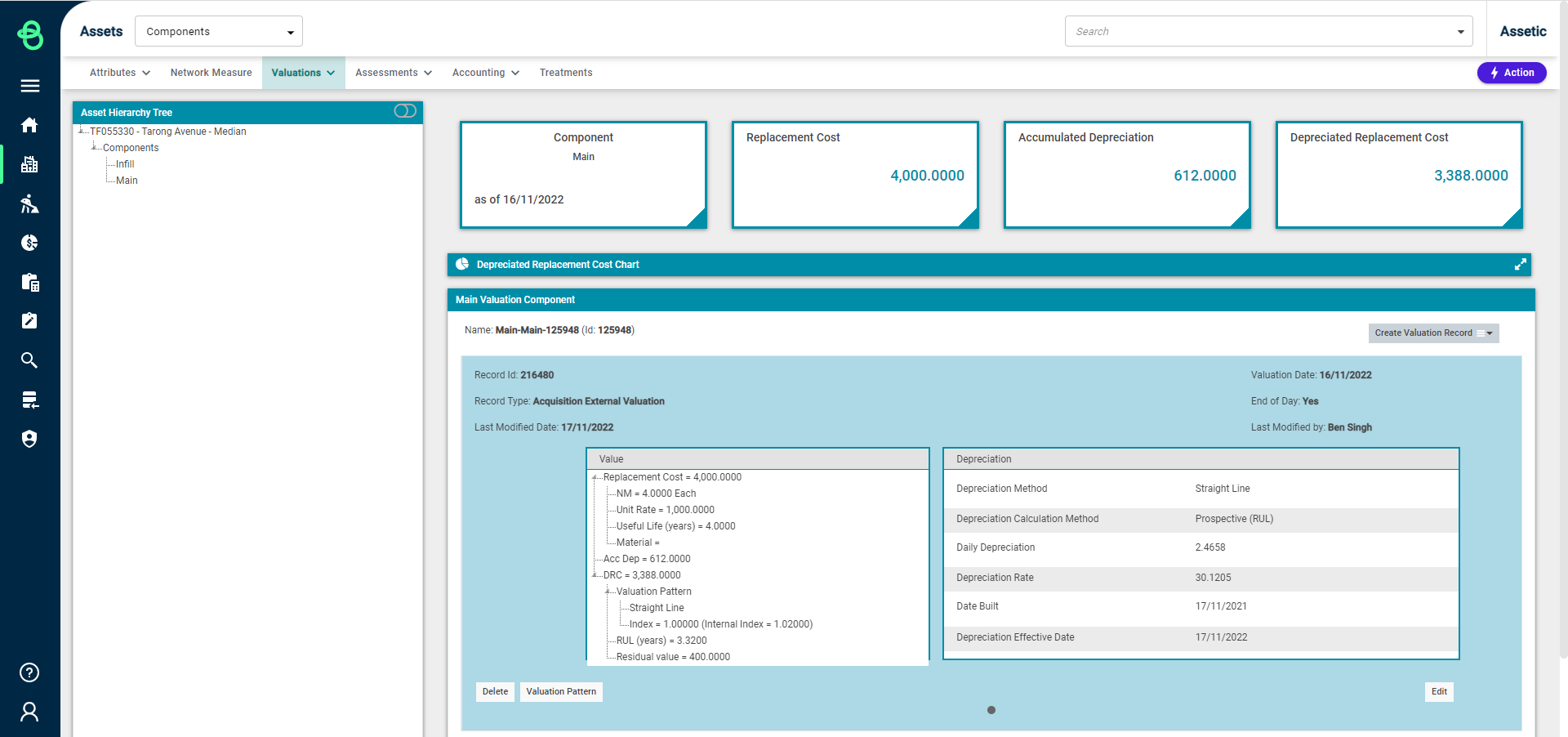

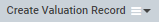

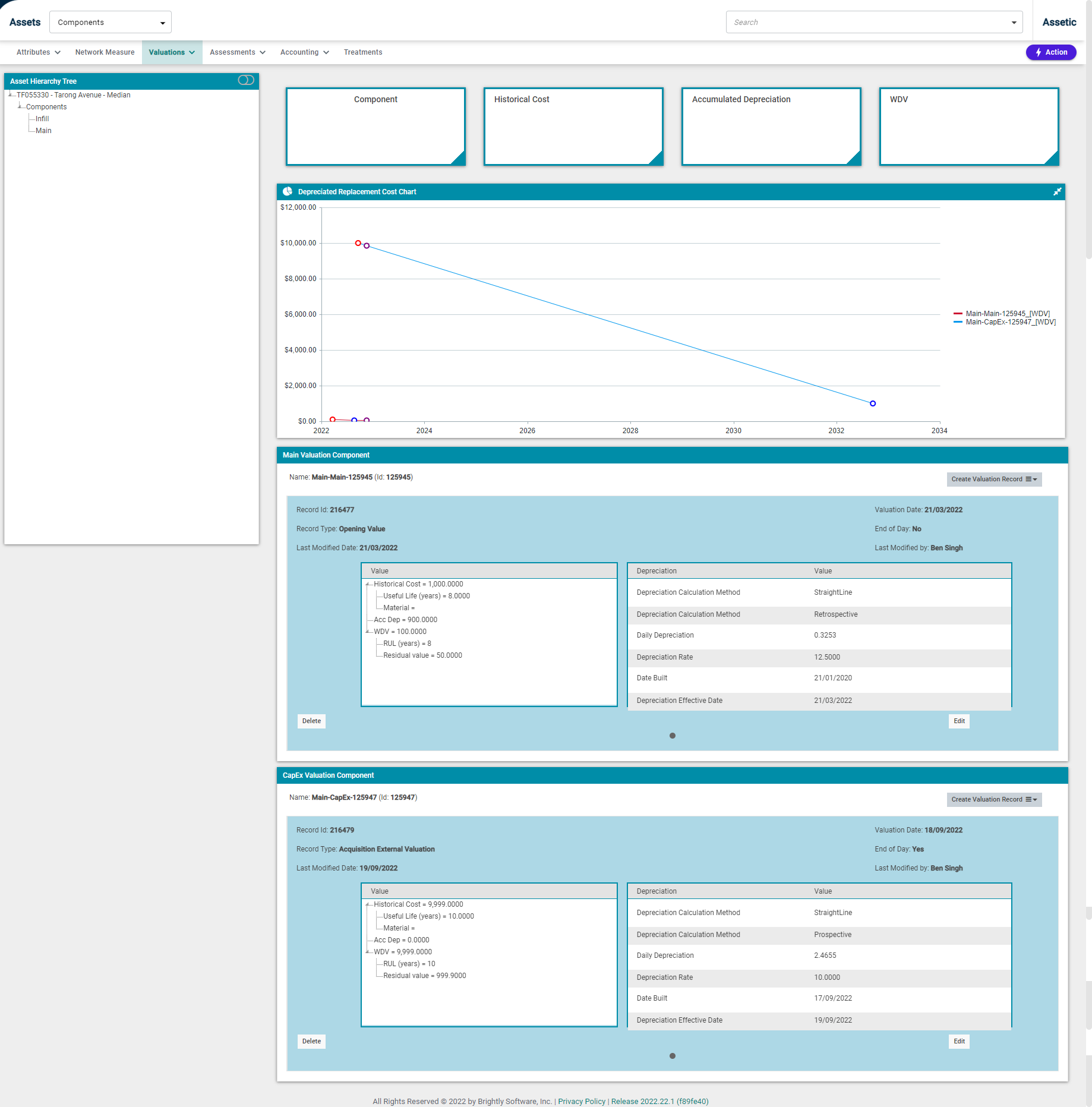

Once the valuation component has been saved it will appear in the Fair Valuation dashboard, as shown below, with the chart box collapsed:

Click on the menu icon  and the list of Valuation Records that can be created is displayed.

and the list of Valuation Records that can be created is displayed.

Valuation Records are limited to one start of day and one end of day record, per day, per Valuation Component, in order to prevent the accidental creation of duplicate records.

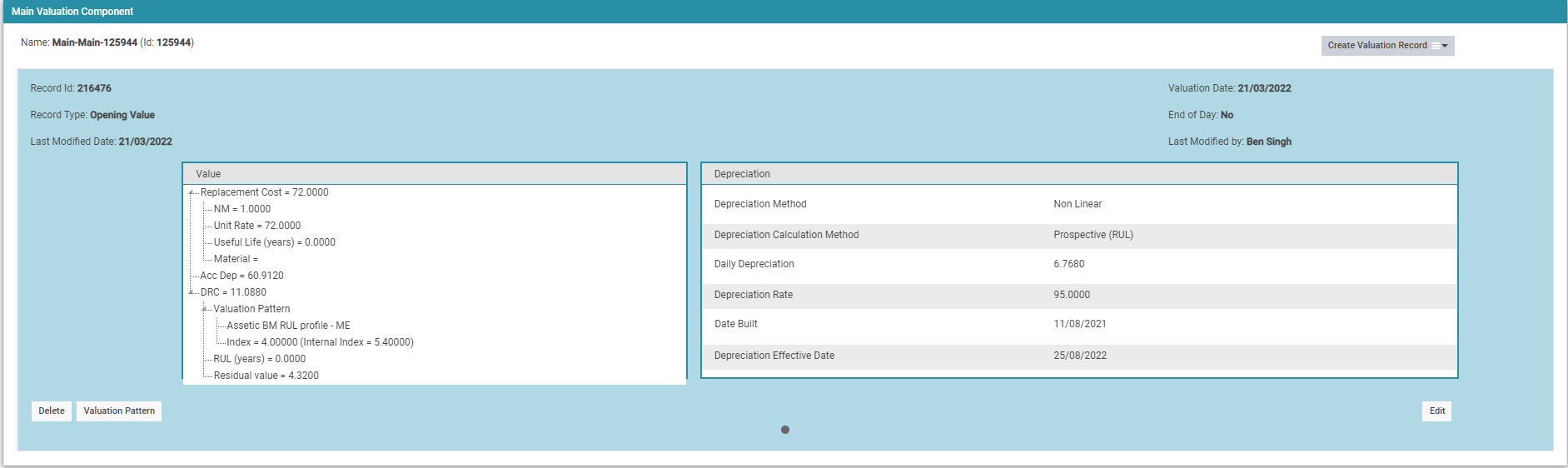

Perform CapEx Valuation

By clicking on this button, the user will be taken to the Capex Detail page as shown below:

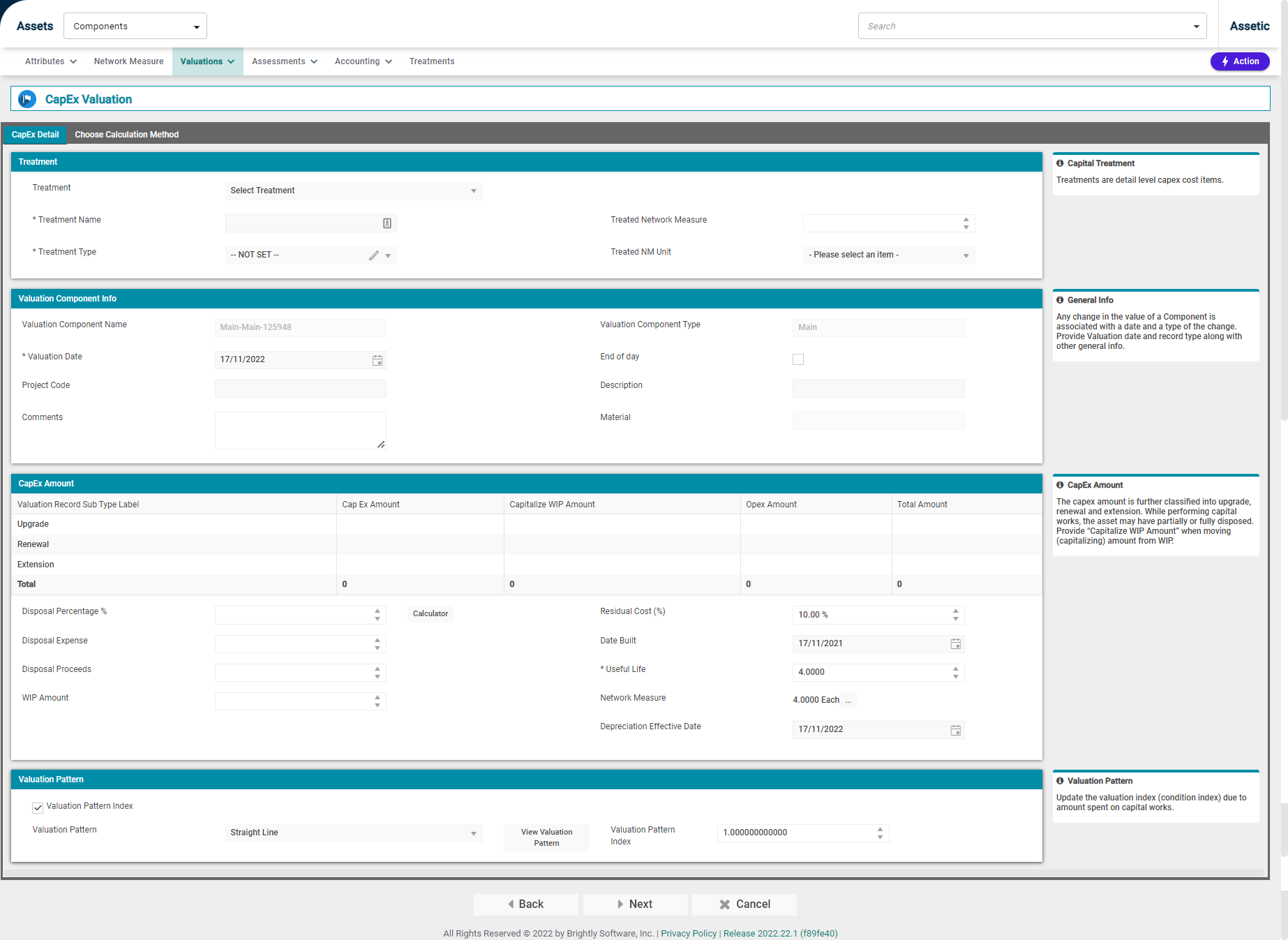

Perform Adjustment Valuation

Upon clicking on the Perform Adjustment Valuation button, the user will navigate to the Adjustment Valuation wizard as shown below:

NOTE Selecting the 'Override RUL?' checkbox within the Remaining Useful Life grid enables the 'Remaining Useful Life' field and allows the previously calculated remaining useful life to be overwritten with a new value.

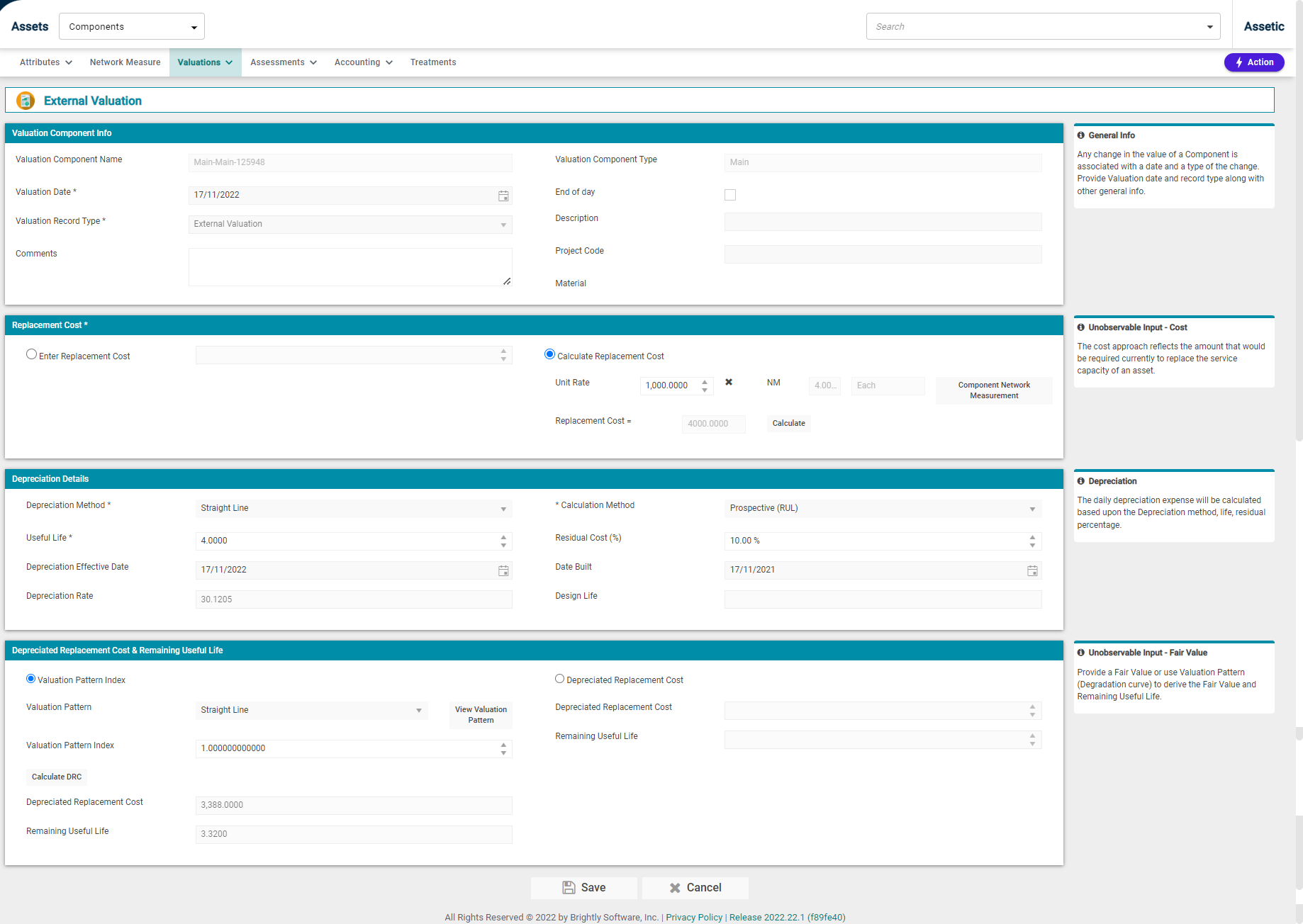

Perform External Valuation

External Valuations can only be performed in the Fair Value Ledger and for the "Main" and "CapEx" Valuation Component types.

Upon clicking this button, the user will navigate to the External Valuation wizard:

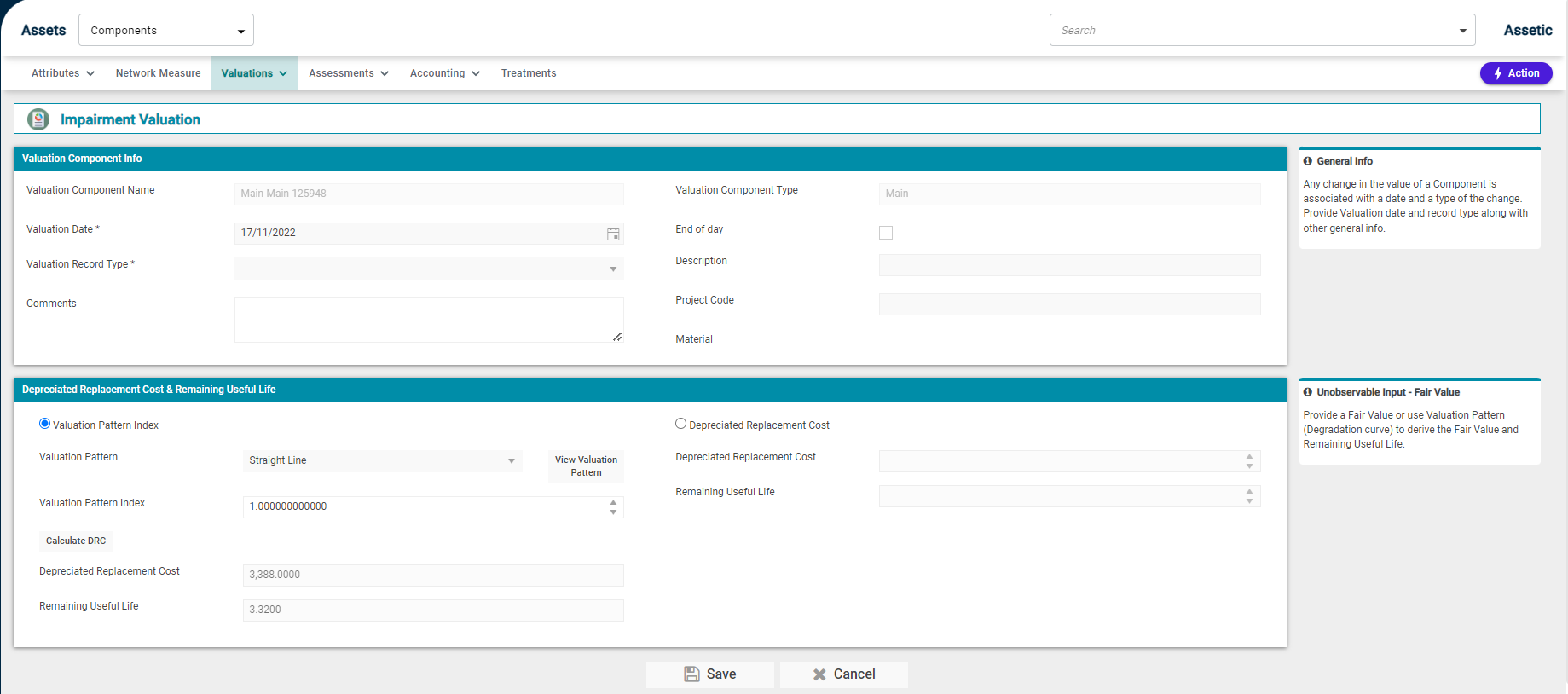

Perform Impairment Valuation

Upon clicking on the Perform Impairment Valuation button, the user will navigate to the Impairment Valuation wizard as shown below:

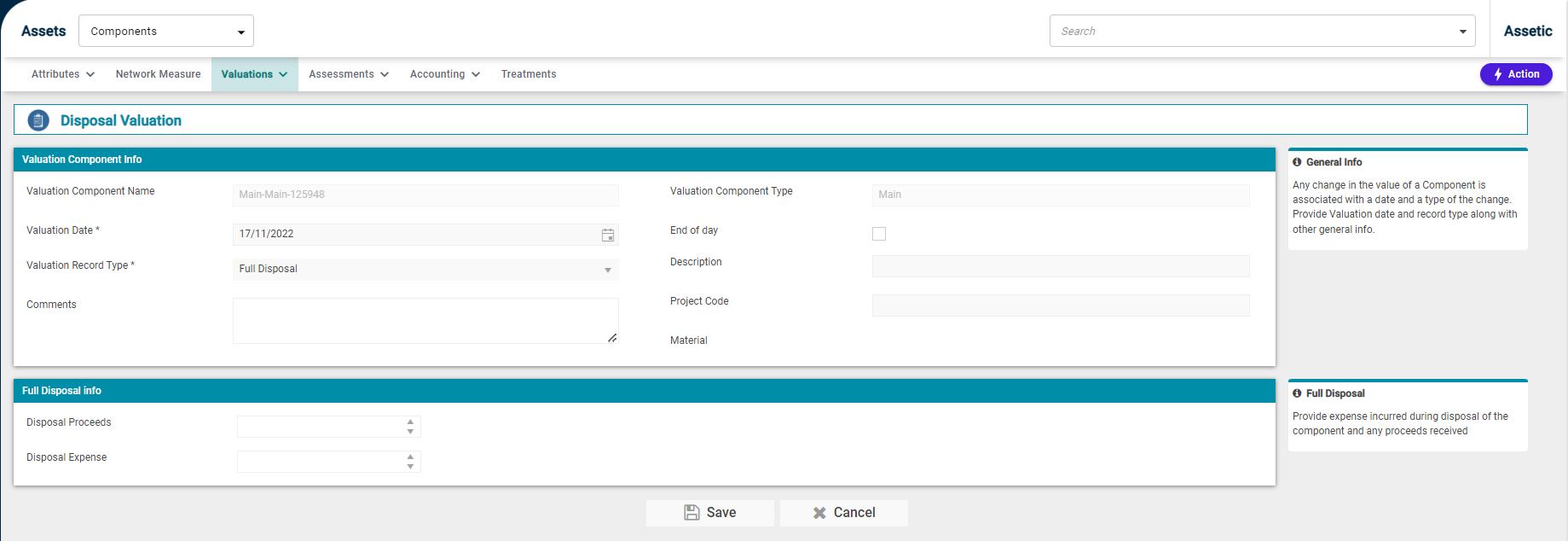

Perform Disposal Valuation

The disposal option the user to Dispose Valuation Component (Main & CapEx). Clicking on this will take the user to the following page:

Once changes are made, click the Save button to finalize the changes and return to the Fair Valuation dashboard.

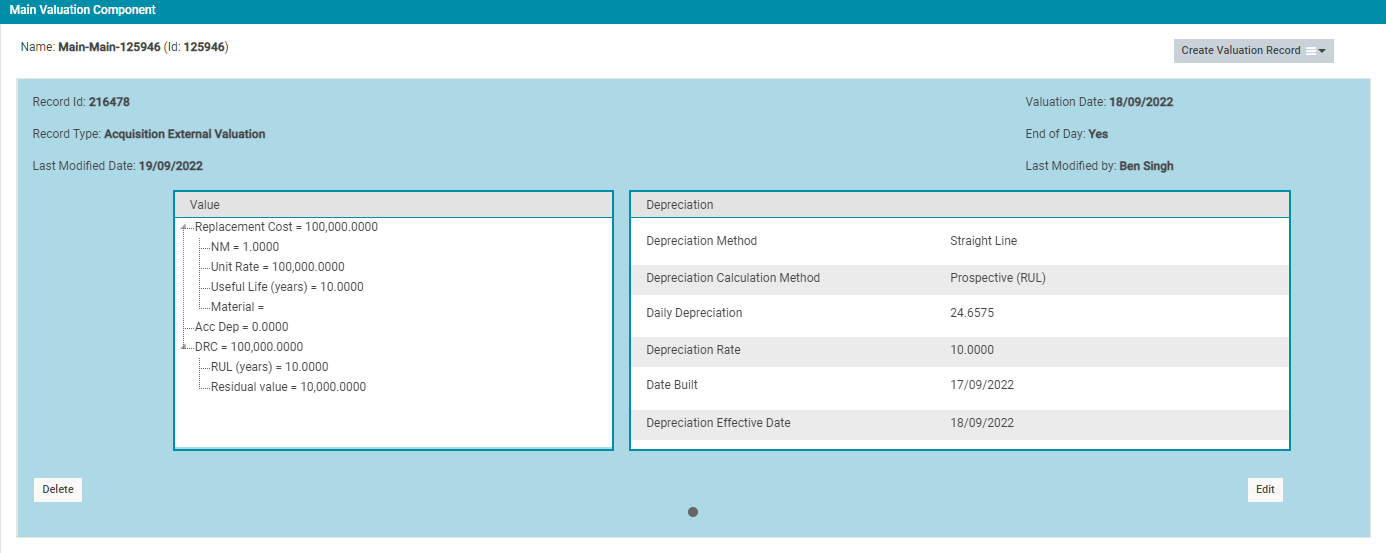

A comprehensive view of the Valuation information can be seen in the Main Valuation Component window. If there are multiple entries, the arrow buttons on the left and right side of the window can be used to navigate between each entry.

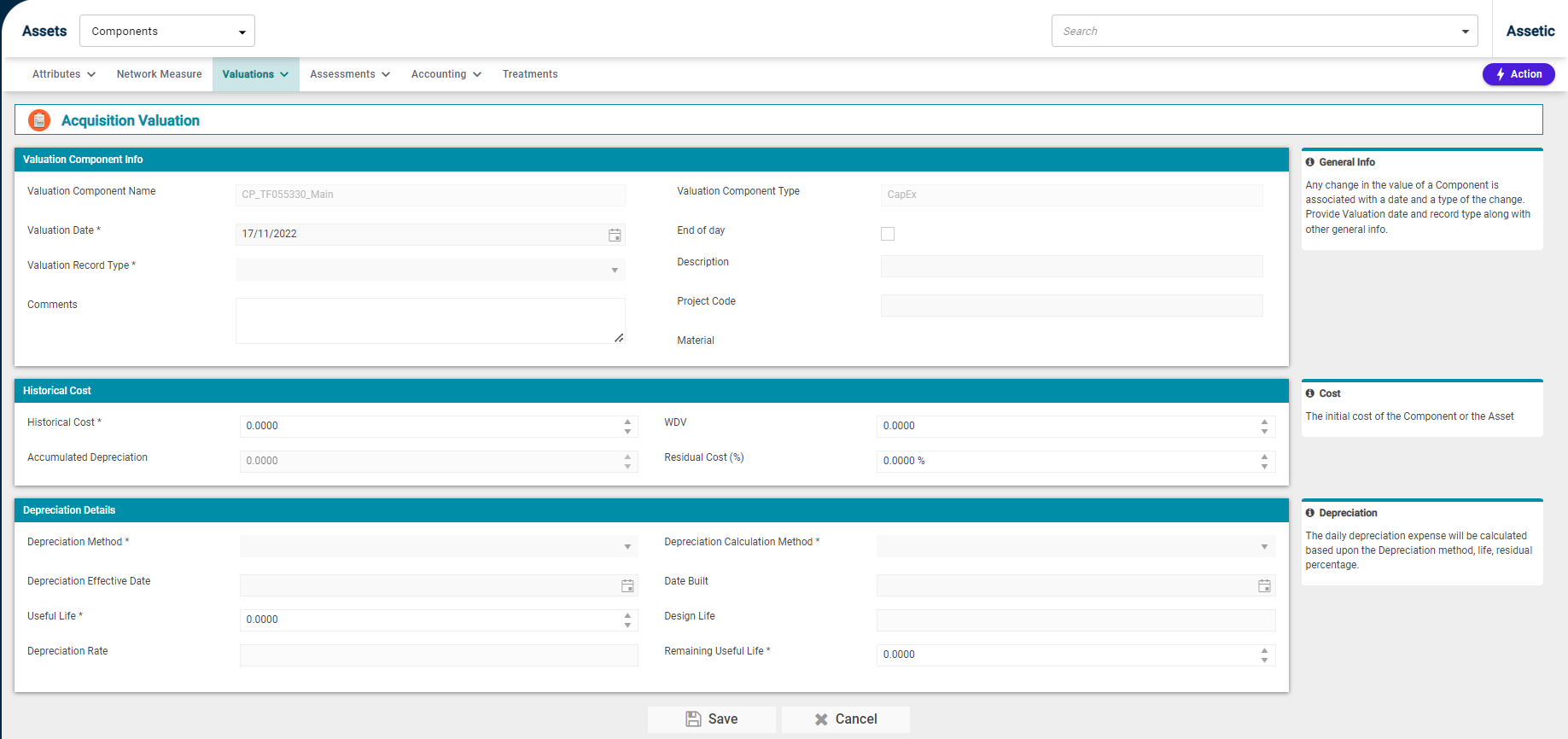

Historical Value

In this example, the option 'Historical' is selected from the 'Valuations' drop-down.

Next, choose 'Create Valuation Component' from the Actions menu.

The following screen will display:

Each section found here is used in the creation of a Valuation Component and is detailed below.

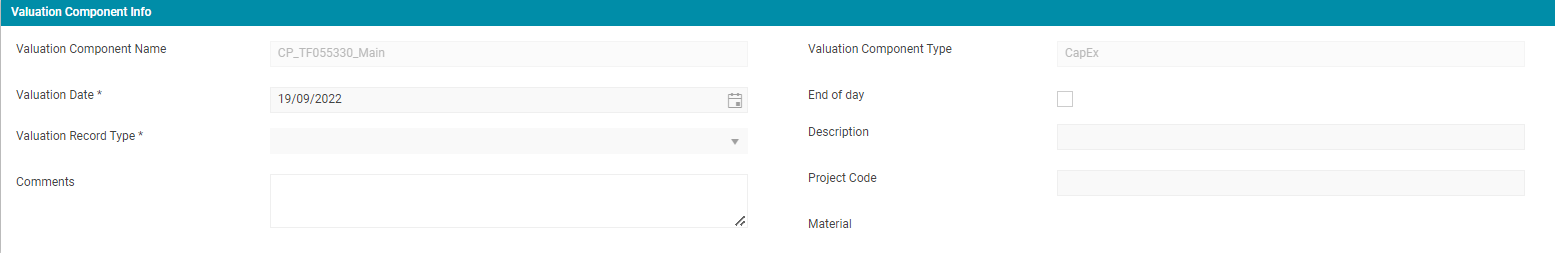

Valuation Component Info:

-

Valuation Component Name: This is not user-configurable and is populated from the parent component reference.

-

Valuation Date*: A mandatory field that is pre-filled with the current date.

-

Valuation Record Type*: This is a mandatory field which allows the user to select a valuation record subtype under Acquisition. For a 'Main' valuation component, the available record subtypes are: Purchase, Opening Value, Found Current Period, Found Prior Period, Gifted, Constructed. For a 'Capex' valuation record, the available record subtypes are: Purchase, Opening Value, Acquisition External Valuation, Found Current Period, and Found Prior Period.

-

Comments: A free-text box for any additional information.

-

Valuation Component Type: This is not user-configurable and is populated from the parent component record. On a component with no valuation component records, the first acquisition will always be Main, and all subsequent entries will be Capex.

-

End of day checkbox: This indicates when the valuation is measured from. If checked, the valuation will be measured from the start of the next day.

-

Description: A free-text field where the description can be stored.

-

Project Code: This can be used to allocate the valuation to a specific project.

-

Material: This field is with the Material from the Parent Component, and cannot be directly modified at the Valuation level.

-

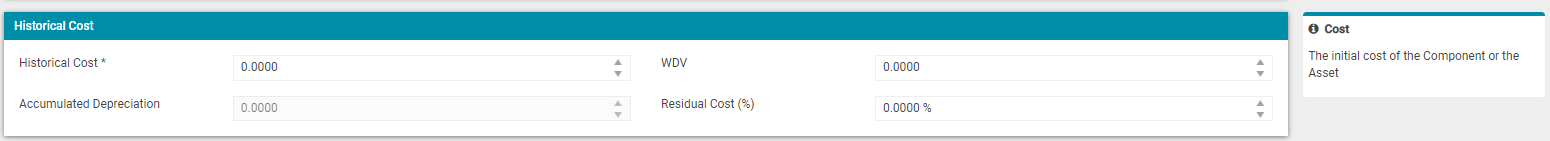

Historical Cost:

-

Historical Cost: This field is a mandatory field and requires a numeric input.

-

Accumulated Depreciation: This is a non-editable field.

-

Written Down Value: This is the cost of the component that was written down in the accounts. The user needs to input a numeric value.

-

Residual Cost (%): This is the remaining value of an asset after it has been fully depreciated, as a percentage.

-

Depreciation Details:

Depreciation Method: Is a mandatory drop-down field from which one of the following Depreciation Methods must be chosen:

-

Straight Line

-

Declining (Reducing) Balance

-

Diminishing Value

-

Prime Costs

-

Low Value Pool

-

Depreciation Effective Date: Depreciation Effective Date is the date from which depreciation is calculated.

-

Useful Life: Useful Life is a mandatory field.

-

Depreciation Rate: Depreciation Rate is not editable and system calculated based on the previous inputs.

-

Depreciation Calculation Method: Is a mandatory field that contains the following options:

-

Prospective (RUL): This is a forward-looking approach to calculating the depreciated replacement cost.

-

Retrospective (UL): This approach is used to calculate depreciated replacement cost if the initial asset value requires updating that will affect the depreciated value.

-

Retrospective (Estimated UL): This is backward-looking with an estimated approach to calculating depreciated replacement cost.

-

Date Built: Date Built is the date when the asset was constructed.

-

Design Life: Design life is not editable and is system calculated based on the previous inputs.

-

Remaining Useful Life: This is the value of the asset if it was sold at the end of its useful life. For example, a vehicle that has 20-year life may still have a residual value when it is sold after 20 years. This field is optional.

Once the required fields are populated, select Save to finalize and return to the Historical Valuation dashboard.

-

Valuation Chart: This is a line chart that is displayed once the Acquisition records for the components are created. The valuation chart displays the WDV and Salvage value with respect to time in Years, and shows relevant points on the line including the current day.

NOTE Multiple valuation components can be created for a physical Component. The first record created is a Main acquisition and all the subsequent records are Capex.

NOTE Bulk Adjustment Valuations of components can be updated via Data Exchange, see the Bulk Update of Components with Adjustment Valuation article.

Valuation Templates

As the Templates available in Data Exchange are in a csv format and do not have additional information about the field definitions and mandatory field details, an annotated Excel version of the same files with related information and sample data is available here.

-

Acquisition Fair Value

-

Adjustment Valuation

-

CapEx Valuation

-

External Valuation

-

Full Disposal Valuation

-

Impairment Valuation